The role of HR in risk management in banking

Silicon Valley Bank and Credit Suisse have been the talk of the town lately. While the world waits to hear more about what happened, one might wonder if the banks’ HR leaders could have overlooked some critical hints before these institutions faced full-blown crises. For example, HR leaders could have effectively monitored and assessed potential risks related to loan or investment portfolios, or they could have better managed talent, avoiding issues such as underperformance or misconduct going unnoticed.

While the cause of the recent crisis is still being determined, one factor that Silicon Valley Bank and Credit Suisse have taken seriously is their approach to risk management. Check out HRForecast’s report on how the risk management issue in banking has shaped the job market over the last year.

In this blog post, we examine the role of HR in risk management in banking. Let’s begin with understanding what risk management is all about.

Risk management in banking refers to identifying, assessing, and controlling risks associated with the banking business. Banks are exposed to a variety of risks, including credit risks, market risks, liquidity risks, operational risks, and regulatory risks. But where does HR fit into risk management?

The role of HR in risk management in banking

HR plays an essential role in identifying and mitigating risks in the banking industry. Here are some risks that the HR department/function can help to avoid:

Operational risks: HR can help reduce operational risks by ensuring employees are appropriately trained and equipped to perform their jobs effectively. This includes providing training on processes, procedures, and regulatory requirements.

Compliance risks: Banks are subject to a wide range of regulatory requirements, and HR can help to ensure that a bank complies by developing and implementing policies and procedures, conducting regular compliance training, and monitoring regulatory compliance.

Fraud risks: HR can help to mitigate the risk of fraud by conducting thorough background checks on employees and implementing internal controls to prevent and detect fraudulent activities.

Reputational risks: HR can help protect a bank’s reputation by ensuring employees know the importance of ethical behavior and creating a culture of accountability and transparency.

Talent risks: HR can help to mitigate talent risks by ensuring that a bank has a diverse and skilled workforce, implementing employee engagement programs to promote retention and productivity, and identifying and addressing potential talent gaps.

By implementing effective risk management practices, HR can help to ensure that the bank can operate stably and securely, protect its financial assets, and maintain stakeholders’ trust and confidence.

Example of how HR helped mitigate a bank risk

One example of how HR helped mitigate a bank risk is the case of JPMorgan Chase’s “London Whale” scandal in 2012. An employee named Bruno Iksil made a series of trades that resulted in losses totaling over $6 billion for the bank’s Chief Investment Office. The losses were caused by risky trades, inadequate risk management controls, and ineffective oversight.

JPMorgan Chase changed its risk management practices after the scandal, including strengthening its compliance and risk management functions. HR played a crucial role in implementing these changes by hiring 3,000 new employees to set up a team of specialists with significant experience in risk management and compliance. They were tasked with improving the bank’s compliance culture and risk management practices. They also were to educate employees about the importance of risk management and help them understand their roles in mitigating risk and complying with regulations.

By strengthening its risk management functions, JPMorgan Chase restored confidence in its operations and maintained its reputation as a trusted financial institution.

Future HR challenges related to risk management in banking

The role of HR in risk management in banking is crucial as human capital is a significant factor in identifying, assessing, and controlling risks in a bank. Here are some key challenges HR departments face while dealing with risk management in banking.

Attracting talent

According to the What’s Going on in Banking 2022: Rebounding from the Revenue Recession report by Cornerstone Advisors, 67% of bank respondents mentioned attracting talent as a top concern for 2022, up from 19% in 2021. The first step in managing risk is to hire the right people for the job by attracting the right talent. Common challenges HR leaders face include:

Competition for top talent: Banking is highly competitive, and top talent is in high demand. Banks may struggle to attract and retain the most qualified candidates.

Limited pool of candidates: Certain roles within banking may require specialized skills or experience, making it challenging to find qualified candidates. Additionally, banks may be limited in their search for candidates due to geographic location or other factors.

Compensation and benefits: Banks must offer competitive compensation and benefits packages to attract and retain top talent. This can be difficult for smaller banks or those with limited resources, especially when competing against larger institutions.

To address these challenges, banks may need to build a strong employer brand, develop a robust talent acquisition strategy, offer competitive compensation and benefits, and invest in employee training and development programs. They may also need to be willing to adapt to changing industry trends and prioritize diversity and inclusion in their hiring practices.

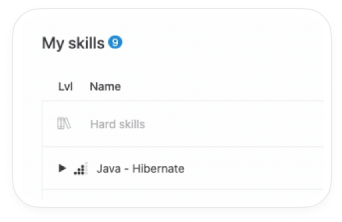

Hire with data, not a gut feeling

Our smartHire feature helps you hire new employees while knowing the average time to hire, salary ranges in a particular area, a comprehensive overview of future skills, and more.

Upskilling the workforce

According to research published by the World Economic Forum and PwC, the financial services industry could boost global GDP by US$263 million by 2030 if upskilling were implemented in a way that closed current skills gaps.

Another survey from PwC’s 22nd Annual Global CEO Survey shows that 80 percent of CEOs in the banking and capital markets industry believe skills shortages threaten their ability to evolve quickly.

Several upskilling training programs can help employees understand the risks associated with banking and develop the skills and knowledge needed to manage those risks effectively. Here are some examples:

Risk management training: This type of training is designed to help employees understand the principles of risk management, including risk identification, assessment, and mitigation strategies. Training can cover topics such as credit, market, operational, and compliance risks.

Anti-money laundering (AML) training: AML training is essential for employees who work in customer due diligence, transaction monitoring, and reporting suspicious activity. This training covers the legal and regulatory requirements related to money laundering and terrorist financing along with methods criminals use to launder money.

Cybersecurity training: Cybersecurity training helps employees understand the risks associated with cyber threats, such as data breaches, phishing attacks, and malware. The training can cover network security, password management, and incident response topics.

Fraud prevention training: Fraud prevention training is designed to help employees identify and prevent fraudulent activities such as identity theft, forgery, and embezzlement. The training can cover fraud indicators, internal controls, and reporting procedures.

Compliance training: Compliance training covers the legal and regulatory requirements that banks and financial institutions must adhere to, such as consumer protection laws, anti-bribery laws, and data privacy regulations.

But remember, the first step to upskilling is identifying where the skills gaps lie. Check out our FREE guide to understand all skills gaps and invest in employee upskilling that can improve productivity, increase employee satisfaction, and drive business success.

Succession planning

What did the case of Citigroup in 2007 and the Axis bank fiasco in 2009 have in common? Both banks failed to lay out and execute an effective succession planning program.

Banks can ensure their long-term success and stability by ensuring critical roles are filled quickly and effectively, promoting talent development, and mitigating the risk of losing key personnel. Here are some ways in which succession planning can help manage risk in the banking industry:

Minimize disruption: Succession planning ensures critical roles are filled quickly, minimizing operational disruption. This is especially important in the banking industry, where a sudden loss of key personnel can significantly impact the organization’s financial stability and reputation.

Ensure continuity: Succession planning ensures continuity of leadership and the organization’s culture. It defines a clear plan for transitioning leadership and maintaining the organization’s values and objectives.

Mitigate risk: Succession planning helps mitigate the risk of losing key personnel by ensuring qualified and capable individuals are ready to step into critical roles. This helps the organization avoid the costs of recruiting and training new employees along with potential reputational damage resulting from sudden leadership changes.

Effective risk management is critical to the success of any bank or financial institution. A robust risk management in banking strategy protects the organization from potential losses, helps it build a strong reputation, and earns the trust of customers and investors.

If you’re looking to enhance your HR team’s capabilities and improve your risk management strategies, we’re here to help. Contact our consultants for comprehensive risk management solutions tailored to the banking industry’s workforce needs.

Stay up to date with our newsletter

Every month, we’ll send you a curated newsletter with our updates and the latest industry news.

info@hrforecast.de

info@hrforecast.de

+49 89 215384810

+49 89 215384810