Global labor market insights: March 2023 edition

Although the economic slowdown in many regions of the world continued in March 2023, in the global labor market, this deceleration isn’t as severe as what we’ve seen in previous years (during the previous crises).

Additionally, ailing banks dominated the news this March. You might hear that Silicon Valley Bank and Credit Suisse caused significant financial difficulties for the financial sector and beyond. Thus, the question arose if the spectacle of the last financial crisis is now repeating itself. How well-equipped are banks with large risk management systems? We’ll share our findings about this below. But first, let’s start with insights into the global labor market situation in March 2023.

This month, we observed a total of 16.3 m job postings globally

We’ve observed a decline in job postings worldwide for the second consecutive month. Our data indicates that global job investment is 25% below the peak we measured only two months ago, in January 2023. It’s the most significant reduction since the COVID pandemic disrupted labor markets in March-April 2020. It remains to observe whether this signals the onset of a global recession or if the labor market is reverting to a more stable position after the upheaval of the big layoffs. Let’s see what is going on with the job demand.

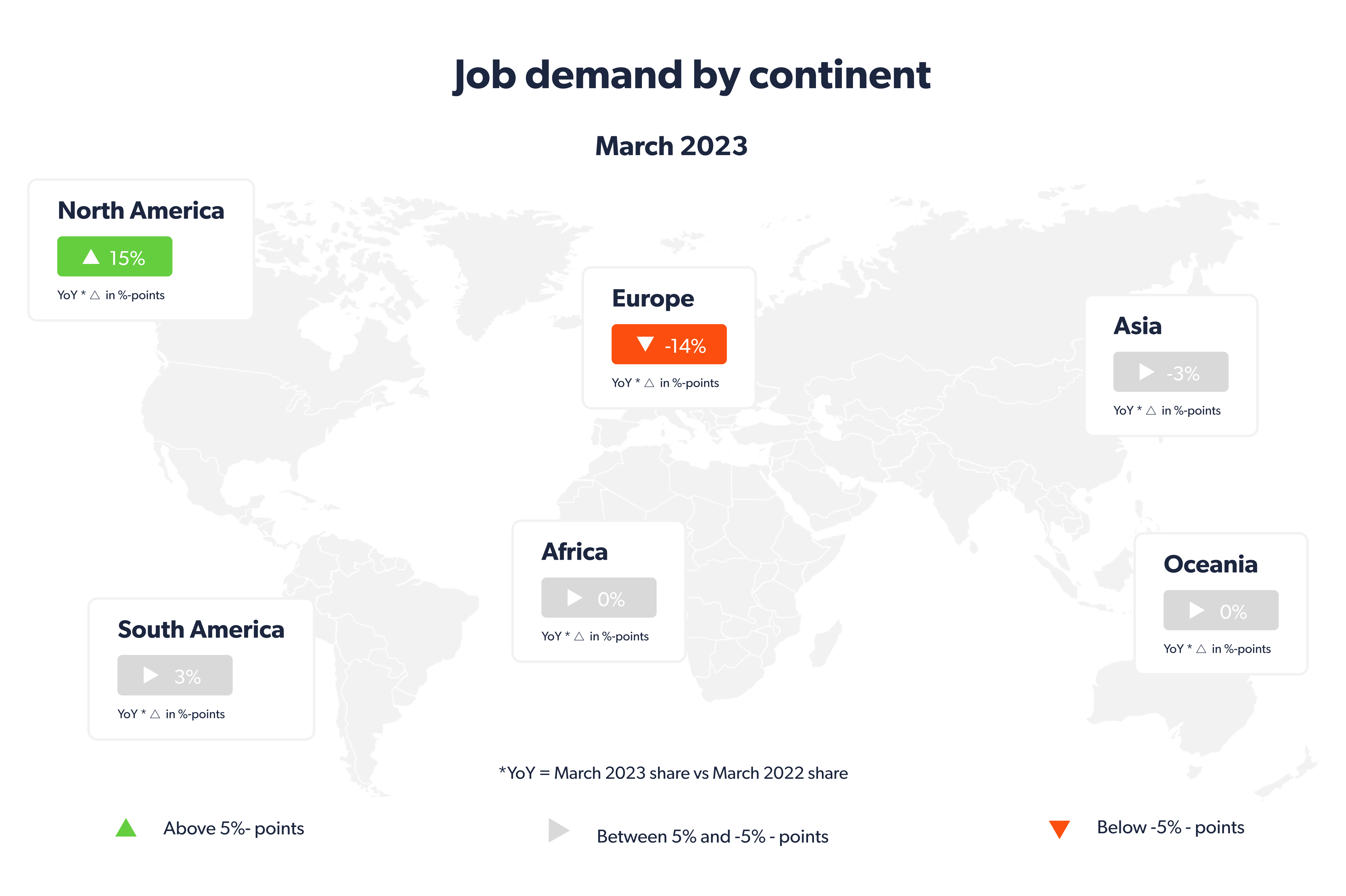

Job demand by continent

When we examine the major global regions, few changes have been compared to last month’s findings. For instance, Europe continues to experience the fastest decline in the number of job postings (the global share has decreased by 14 percentage points compared to March 2022), while the US labor market remains more active than it was one year ago (the global share has increased by 15 percentage points compared to March 2022). According to the US Bureau of Labor Statistics, US employers added 236,000 jobs in March.

Job postings by country (in millions)

Eight of the ten countries included in this analysis saw a decrease in job postings compared to last month. The most significant declines have occurred in Japan (down 50%), Great Britain (down 30%), and the United States (down 14%). These numbers suggest that the “Great Resignation” is losing momentum, and a cooled-down economy has entered the labor market. Russia (new on the top-10 list) and Germany (up 7%) exhibit signs of stability in the labor market.

Currently most common job titles

Engineers of various types are in high demand. We observed such newcomers as Project, Electrical, and Data engineers join the global top 25 jobs list. They have replaced positions like Pharmacist, Marketing Manager, and Electrician. While there were minor changes in the job titles, the health and IT sectors continue to have the highest job demand.

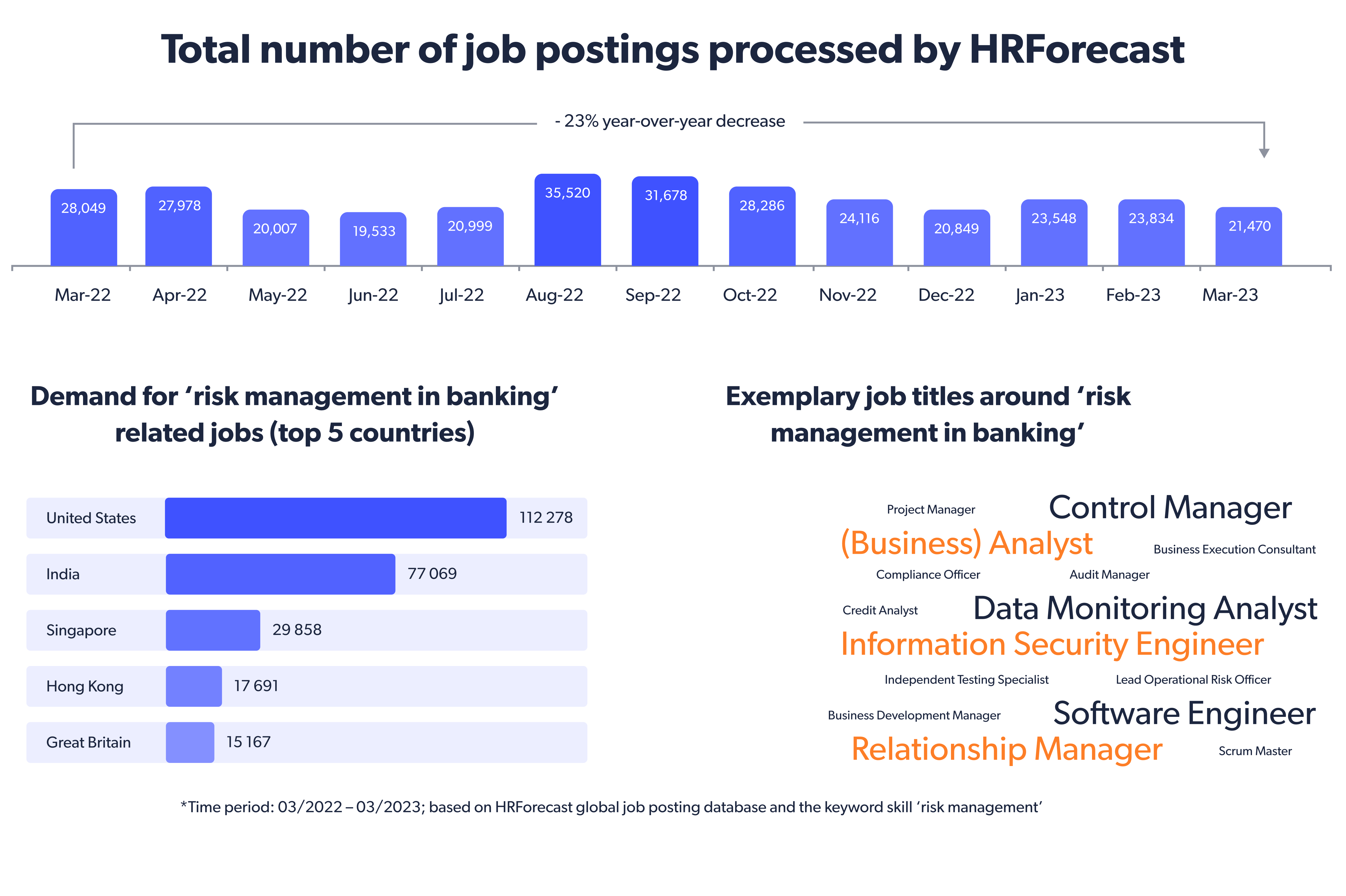

Is risk management within banking (again) gaining in importance?

Although the markets seem to have regained some composure, March remained turbulent for investors. The specter of a systemic banking crisis has caused significant volatility in equity and bond markets following the collapse of Silicon Valley Bank in the US and fears over Credit Suisse in Europe.

What happened with the banking system?

The current situation is partly due to a significant increase in interest rates in 2022. As a result, Silicon Valley Bank was forced to sell its long-maturity bonds to offset cash withdrawals from its customers. So, the bank suffered significant losses. They provoked a vicious cycle that ensued as nervous depositors scrambled to withdraw their cash. Fear grew about the bank’s development, forcing it to incur further losses and weakening its financial position. The bank collapsed, and the Federal Reserve and regulators stepped in to help depositors pour money into the business to improve liquidity.

So, can it be that the financial crisis is now repeating itself? What is happening with the risk management systems in banking?

We searched for a skill like risk management in the job postings of the 50 largest banks in the world and were surprised to see that the demand for this skill is still growing. Besides, we found two interesting insights:

- The banks are already well-equipped with internal talents in risk management, or

- There’s a disconnect between the business requirements (= build and maintain an effective risk management system) and labor market strategy (= provide suitable talent to support risk management).

- Credit Suisse is in the very last position when analyzing the job postings involving risk management skills of the ten largest global investment banks.

In conclusion

So, March was a very interesting month for analyzing the labor market. The global labor market slowed, with job postings declining for the second month. However, the slowdown isn’t yet expected to lead to a significant increase in unemployment. Regarding job demand, the IT sectors continue to occupy the highest positions.

In the banking sector, the collapse of Silicon Valley Bank and the financial difficulties of Credit Suisse have raised concerns about the banking system’s stability. The demand for risk management skills is increasing, and the lack of adequate personnel to support risk management may be a possible explanation for the banking sector’s vulnerability. Yet, there is a gap between business requirements and labor market strategy. So, we will need more analytics and time to understand the cause of the instability in the banking sector and whether it could lead to a repeat of the 2008 financial crisis.

Download the report to learn more about the roles and skills in demand in March 2023. See in more detail what is happening with risk management in the banking sector.

Stay up to date with our newsletter

Every month, we’ll send you a curated newsletter with our updates and the latest industry news.

info@hrforecast.de

info@hrforecast.de

+49 89 215384810

+49 89 215384810